The Mexican Congress has announced plans to introduce a $42 immigration tax on cruise passengers visiting its ports, slated to take effect in 2026. The tax, part of a broader effort to address the nation’s fiscal deficits, has sparked a heated debate within the tourism industry and beyond. Cruise lines, local businesses, and industry experts warn that the levy could jeopardize Mexico’s standing as a top cruise destination in the Caribbean.

The new immigration tax aims to generate additional revenue for Mexico, with a significant portion reportedly earmarked for military spending. However, critics argue that this allocation could hinder tourism development, the very sector the tax relies on. Historically, cruise passengers have been exempt from such fees since they typically remain aboard their ships during port visits. Instead, port fees—paid as part of the cruise fare—cover costs like pilotage, docking, and per-passenger charges.

Under the new legislation, the tax applies to every cruise passenger, regardless of whether they disembark, adding to the costs already borne by tourists and cruise lines.

Major cruise lines, including Carnival, Royal Caribbean, and Norwegian, have vocally opposed the tax. These companies fear that the added expense could deter travelers, prompting them to choose alternative destinations. The Florida-Caribbean Cruise Association (FCCA) has formally urged Mexican President Claudia Sheinbaum to reconsider, warning that the tax could discourage over 10 million annual cruise passengers from visiting Mexico.

The Mexican Association of Shipping Agents echoed these concerns, emphasizing that the tax might make Mexican ports among the most expensive worldwide. A spokesperson noted that such a move could significantly reduce Mexico’s competitiveness in the region, potentially shifting itineraries to neighboring nations with more favorable conditions.

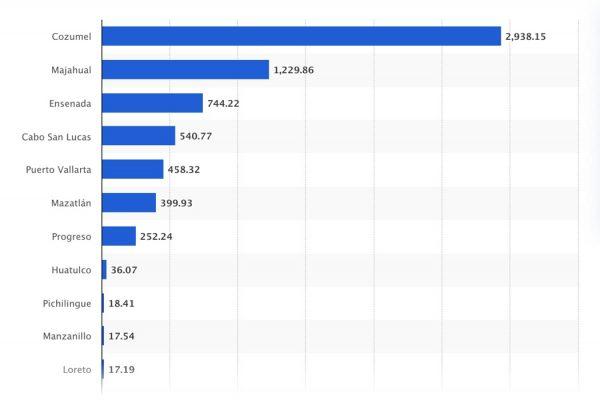

For local communities, particularly in regions like the Yucatán Peninsula, cruise tourism is a vital economic driver. Destinations such as Cozumel, often dubbed the “cruise capital of the world,” welcome millions of passengers annually. These visitors inject significant revenue into local economies through hospitality, retail, and transportation.

A decline in cruise tourism due to increased costs could spell trouble for small businesses and workers who rely on the industry. Reduced visitor numbers may lead to lower incomes, job losses, and an overall economic downturn in these regions.

The $42 tax is not the only new charge on the horizon. Beginning in 2025, cruise passengers will also face a $5 fee aimed at supporting Mexico’s National Disaster Prevention Fund. While this initiative focuses on recovery efforts from hurricanes and other natural disasters, the cumulative effect of these taxes could make Mexico less appealing to travelers compared to neighboring Caribbean destinations.

Mexico’s Caribbean coast is a fiercely competitive tourism hub, with countries like the Bahamas, Jamaica, and the Cayman Islands vying for cruise itineraries. These destinations boast lower fees and established infrastructures, making them attractive alternatives for cruise lines and passengers.

The $42 tax could tip the scales further in favor of Mexico’s competitors, leading to potential losses in market share and revenue.

Proponents of the tax suggest it may help address over-tourism by reducing the influx of visitors to popular destinations. However, experts warn that higher fees could backfire, driving tourists to less regulated areas or countries with lower costs.

Sustainable tourism initiatives, such as improving infrastructure and adopting environmentally friendly practices, are seen as more effective solutions for managing over-tourism. Critics argue that Mexico risks undermining its reputation as a cruise destination by focusing on short-term revenue generation at the expense of long-term viability.

The Senate’s ongoing debate over the tax offers a chance for stakeholders to find common ground. Industry leaders have called for greater transparency in fund allocation, advocating for investments in tourism infrastructure rather than military expenditures. Such measures could help preserve Mexico’s appeal while addressing fiscal challenges.

Negotiations may also explore alternative funding mechanisms that balance national priorities with the needs of the tourism sector.

Mexico’s decision to impose a $42 immigration tax on cruise passengers represents a pivotal moment for its cruise tourism sector. While intended to address fiscal deficits, the tax risks alienating cruise lines, reducing visitor numbers, and harming local economies.

With cruise prices already at an all-time high, the move could prompt vacationers to choose other options entirely. As an avid traveler, I’m not paying additional costs on top of the port charges and fees we already pay to cruise. At a certain point, it feels like a cash grab with no additional value for the visitor.